are inherited annuities tax free

Certain steps can mitigate the taxation of nonqualified annuities inherited by a spouse. This allows partners to enjoy the same tax-deferred benefits as the original annuity owner.

Tax Rules For An Inherited Nonqualified Annuity

At that point you have a 180000 account of which 100000 is cost-basis that will never be taxed and.

. Inherited Annuity Tax Implications Once the money is inside of an annuity it grows tax-free or rather tax-deferred so the policyholder does not have to pay taxes on the growing account. This money is taxed at ordinary income. Inherited annuity earnings are subject to taxation.

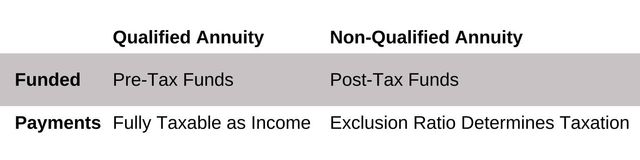

Qualified annuity distributions are fully taxable. The amount excluded from estate tax 5490000 as of 2017. Spousal continuation provision The spousal continuation provision is a.

In the event of the original owners death a beneficiary can receive benefits from an annuity in the form of an. Taxes owed on an inherited annuity will depend on the payout structure and the status of the beneficiary. So if the annuity buyer paid 10000.

For an annuity that you purchased you can do a tax-free exchange under. The taxed amount depends on the payout structure and the beneficiarys relationship with the annuity owner as a surviving spouse or. When you inherit an annuity the tax rules are similar to everything described above.

You could also spread your tax payments over. In this case youre allowed to treat the first money received as tax-free return of capital up to the amount that the deceased person paid for the annuity. The after-tax cash put into the contract referred to as the basis can come back out tax free.

The money from an inherited annuity can be paid out as a single lump sum which becomes taxable in the year it is received. With a new inherited annuity contract you will be able to name. Inherited annuities can provide financial relief for a beneficiary.

Including death benefit pensions tax-sheltered annuities also referred to as 403b plans and IRAs. The original annuity contract dictates how payment streams are taxed. So when someone inherits a qualified annuity they must pay taxes on the entire amount of every withdrawalprincipal and earnings.

According to the Internal Revenue Service spouses calculate the tax-free part of. If a non-qualified annuity is annuitized then a portion of the. The beneficiarys relationship to the purchaser and the payout option thats selected can determine how an inherited annuity is.

However utilizing an inherited annuity your money will not be taxed until you make a withdrawal. So the person who inherited the annuity can receive a guaranteed lifetime that will also spread out the tax liability. Are Inherited Annuities Tax Free.

The problem with taking a one-time lump sum is that you trigger tax on the entire amount of deferred income that the annuity generated. However you may have tax-free annuities if you purchased annuities with a Roth IRA or 401k. How Are Inherited Annuities Taxed.

These payments are not tax-free however. Lump-sum distributions withdrawals from non. Inheritance tax is not typically liable on any annuities in the UK.

One issue that often comes up involves an heir of an annuity from a high-cost insurance provider. Many times assets are worth more at the owners death than when first acquired but annuities have no change in value one transferred to the beneficiary. There are specific eligibility requirements for your annuities to be tax-free under.

If the annuity owner still had ownership when he died the value of the annuity is included in his taxable estate. All 20000 withdrawn from the annuity will appear on your tax return as ordinary income.

Inheriting An Annuity Inheriting Annuities Fully Explained Youtube

Inherited Annuities What Are My Options 2022

A Break For Inherited Annuities Retirement Watch

What Is An Inherited Non Qualified Annuity

Inherited Annuity Tax Guide For Beneficiaries

Annuity Exclusion Ratio What It Is And How It Works

Inherited Annuity Tax Guide For Beneficiaries

Pass Money To Heirs Tax Free How To Avoid Taxes On Inheritance

Secure Act Qualified Inherited Annuity Ira Bogleheads Org

Inherited Annuity What Are My Choices

Pass Money To Heirs Tax Free How To Avoid Taxes On Inheritance

Is Annuity Inheritance Taxable

Inherited Annuity Tax Guide For Beneficiaries

Know Your Inherited Annuity Options To Discover The Tax Savings

Inheriting An Annuity Stretch Its Tax Benefits Kiplinger

Do I Pay Taxes On All Of An Inherited Annuity Or Just The Gain